When buying a home or property in Rochester or the bordering areas of Monroe, Orleans, and Genesee Counties, the acquisition agreement is one of one of the most vital documents you’ll authorize. This contract sets the terms for your real estate transaction and lays out everything from the purchase cost to shutting details. If it’s incomplete or improperly composed, you risk disputes, delays, and even losing the residential or commercial property.

At Klafehn, Heise & Johnson P.L.L.C., we aid customers understand and work out acquisition agreements to protect their investment. Right here’s what every home acquisition contract in New York need to include-and why lawful evaluation is crucial before authorizing.

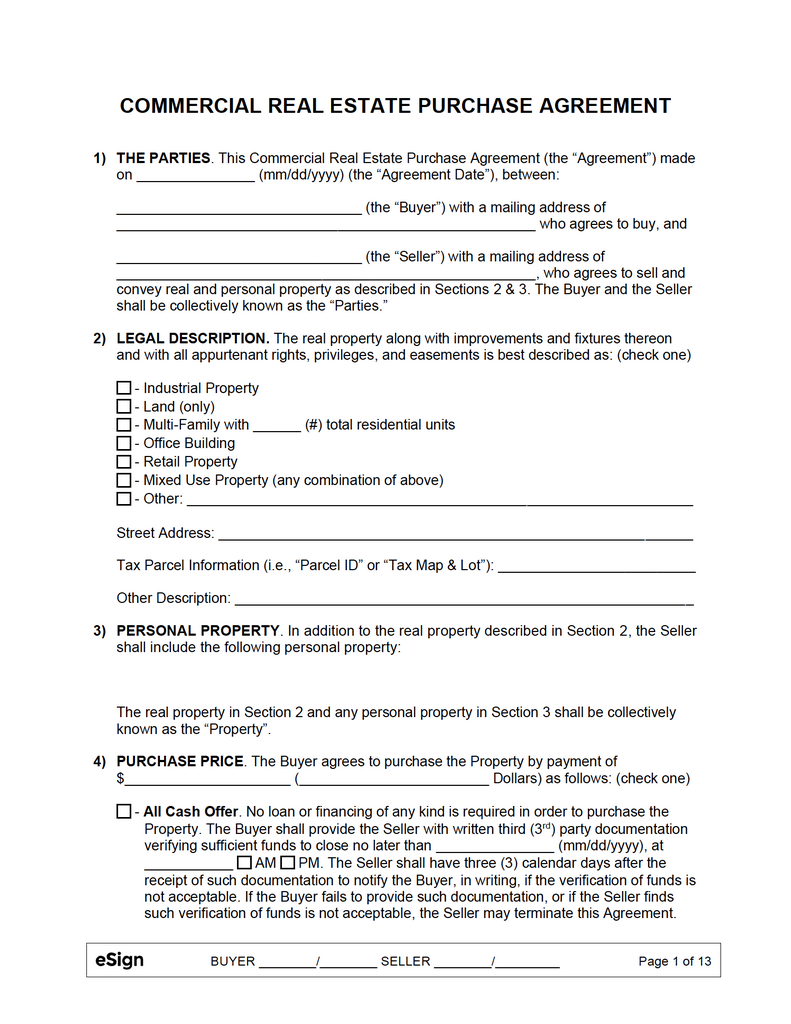

1. Accurate Residential Or Commercial Property Facts

The arrangement must plainly recognize the property being bought, including the right address, tax obligation map number, a general description of the property being communicated and its size and perhaps even the lawful description.Read here washington real estate contract more details At our site Mistakes right here can cause confusion regarding what you’re actually getting and trigger issues at closing.

Pointer: Validate that the descriptive information concerning the home being purchased are correct in the agreement to avoid conflicts later.

2. Acquisition Rate and Settlement Terms

Beyond the overall acquisition cost, the arrangement ought to define:

- Earnest money down payment quantity and due date.

- How the deposit will certainly be held (escrow) and used at closing.

- Financing details, consisting of a mortgage backup and timelines.

- Any kind of vendor concessions or debts set.

3. Contingencies and Conditions

Contingencies provide you a way out of the contract-or a way to renegotiate-if certain problems aren’t fulfilled. Common contingencies include:

- Home evaluation: Permits you to request repairs or back out if significant problems are found.

- Funding authorization: Safeguards you if you can’t protect a home mortgage within an established time period.

- Assessment contingency: Guarantees you do not pay too much if the property assesses less than anticipated.

- Sale of existing home: Offers you time to sell your current home before you are bound to acquire.

Without correct contingencies, you might lose your deposit if something unforeseen develops.

4. Closing Date and Belongings Terms

The agreement needs to lay out the targeted closing day and when you’ll seize the residential property. If the seller needs extra time to move (or you require belongings before closing), those terms ought to be consisted of to avoid misconceptions.

Tip: Consist of flexibility for unexpected delays-such as loan provider stockpiles or title issues-that might push the closing go back.

5. Products Included and Omitted in the Sale

Clearly state what’s included in the purchase-appliances, lighting fixtures, home window treatments, or exterior structures-and what the vendor intends to take. Ambiguity right here is an usual source of conflicts during final walk-throughs.

6. Disclosures and Examination Rights

New York law calls for certain disclosures, like lead-based paint for older homes. The agreement needs to confirm the seller has actually provided or will provide all called for disclosures and enable you time to check the property, if applicable.

It should likewise detail that spends for assessments, how assessment results will certainly be managed, and timelines for repair work negotiations.

7. Title and Deed Provisions

The acquisition arrangement must state that the seller will certainly deliver clear title at closing and determine the type of act to be offered (typically a guarantee act). It needs to likewise define that will certainly pay title insurance coverage costs and closing expenses.

8. Default and Remedies

The contract should define what happens if either event defaults. For instance, if the purchaser stops working to close, does the seller keep the down payment? If the seller backs out, is the buyer entitled to problems or maybe particular efficiency? Clear default provisions prevent complication if the offer fails.

9. Trademarks and Implementation Details

Make certain all parties authorize the contract, consisting of partners or co-owners when called for. Digital trademarks may serve yet should adhere to New York regulation and loan provider requirements.

Why Deal with a Local Realty Lawyer?

Every county in Western New York has special practices for closings, title searches, and related products. A neighborhood lawyer understands these procedures and can recognize possible problems prior to they come to be costly.